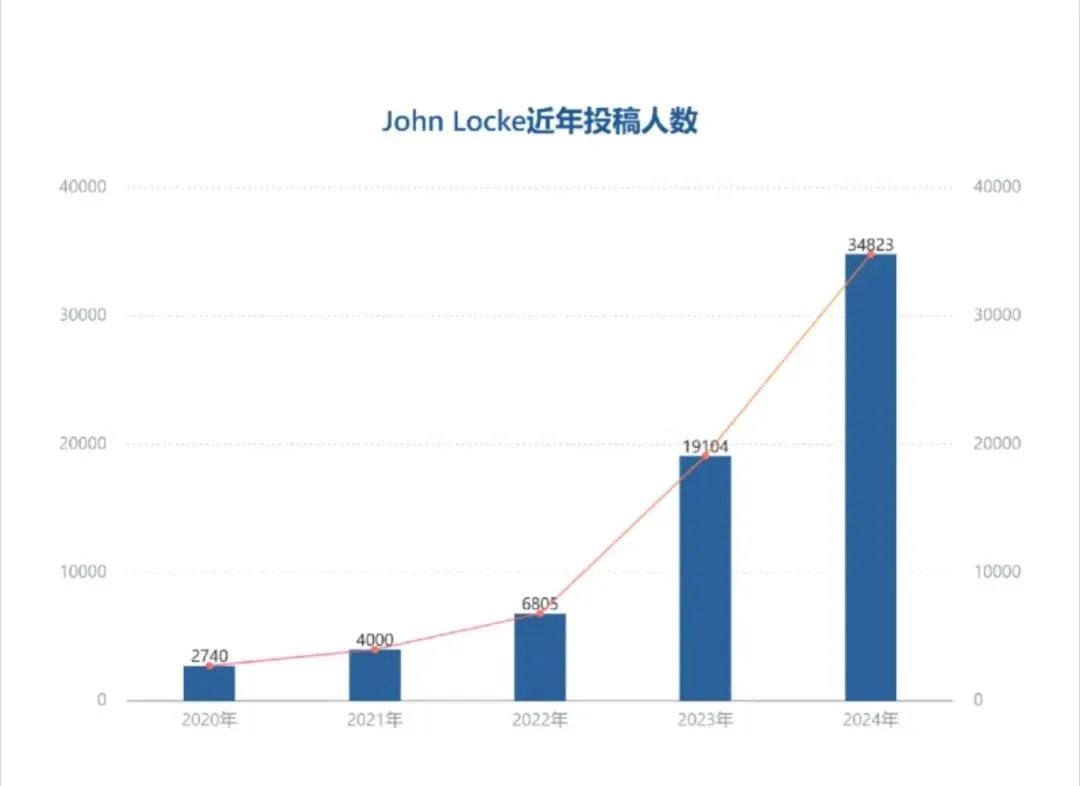

随着John Locke写作竞赛的官方晚宴和颁奖晚会圆满落幕,2024赛季的获奖名单已经公布啦,今年全球共有34823名参赛选手,约有16.9%的参赛者入围,快来看看有没有你的名字吧!

Junior 赛区

Junior Category

Very High Commendations

Alexia Tan, Shanghai High School International Division

Courtney Fong, Rancho Pico Junior Highschool

Damhee Kim, North London Collegiate School Jeju

Elizabeth Xinyi Huo, Cheltenham Ladies CollegeFatima Merchant, St.Christopher's school

Juheon Kim, Fayston Preparatory of Suji

Lily Zhang, Pymble Ladies College

Luna Gao, Munich International School

Mia Pattinson, North London Collegiate School

Minlu Wang-He, Davidson Academy Online

Olha Kiriakova, Astra Nova

Tara Sproules-Nath, Pymble Ladies College

Yuran Wang, Millburn Middle School

3rd Prize

Ihsan Iftikar

The Greenwich Country Day School

2nd Prize

Doria Chen

Tanglin Trust School

1st Prize

Philip Taxiarchis

Westminster School

哲学赛区

Philosophy Category

Very High Commendations

Alida Chan, Tonbridge School

Benjamin Qin, Harrow International School Hong Kong

Elizabeth Zihan Chen, York House School

Serim Kwon, Seoul International School

Tom Gallear, Homeschooled

3rd Prize

Mihyeon Lee

North Raleigh Christian Academy

2nd Prize

Olivia Kang

Davidson Academy Onilne

1st Prize

Kan Zhang

BASIS International School Park Lane Harbour

政治学赛区

Politics Category

Very High Commendations

Ava Clarke-Stevens, James Allen Girls School

Chiara Ma, European School RheinMain

Chloe Liu, Lakeside School

Georgia Kemp, The Sandon School

Tony-JunLin Pan, Jericho High School

3rd Prize

Yijun Zhou

HD Shanghai School

2nd Prize

Marcell Pap

V. Kerületi Eötvös József Gimnázium

1st Prize

Xinen Han

The Experimental High School Attached to Beijing Normal University

经济学赛区

Economics Category

Very High Commendations

Alan Xuan Ming Gu, French International School

Anastasia Salikova, Colegio San José Estepona

Archie Carder, Queen Elizabeth Grammar School

HorncasteArjun Kshirsagar, Tonbridge School

Benjamin Dunn, Wolverhampton Grammar School

Carrie Zixuan Zhang, Crean Lutheran High

Dani Madanat, Rossall School

Hia Rivkin, The National Mathematics and Science College

Jingxing Bi, Cardiff Sixth Form College

Khushi Thapar, Sevenoaks School

Maksim Arbonen, Mill Hill School

Nandini Kumar, Oberoi International School, JVLR

Shubham Baheti, Sutton Grammar School

Yiqui Zhang, Shanghai Pinghe School

3rd Prize

Jiankai Zhao

Raffles Institution

2nd Prize

Audrey Kuk

St Hilda's School

1st Prize

Yuhao Liu

Guanghua Cambridge International School

历史赛区

History Category

Very High Commendations

Arabella Nawaz, Withington Girls School

Felix Lawson-Lyon, Hereford Cathedral School

Huanxi Zhou, Shanghai Starriver Bilingual School

Jessie Shen, Somerville HouseJunting Gan, Nanjing Foreign Language School

Mingda Liu, The Experimental High School

Affiliated to Beijing Normal University

Nicola Tan, St. Joseph's Institution International

Oriana Huang, Dwight Englewood School

Osman Mian, Oxford International College Brighton

Yuntian Zhao, Shanghai United International School, Wanyuan Campus

3rd Prize

Max Collison

Winchester College

2nd Prize

Zack Lam

Richard Montgomery High School

1st Prize

Maximus Sherwood

BHASVIC

法学赛区

Law Category

Very High Commendations

Aaron Brest, Singapore American School

Adrian Lee, Diocesan Boys' School

Alex Lau, Bromsgrove School

Alexander Dunderdale, City Of Bristol College

Emily Ball, Tonbridge Grammar School

lan Khai Ven Ng, Raffles Institution

3rd Prize

George Morrison

Eton College

2nd Prize

Maner Wen

Tianjin Yinghua Experimental School

1st Prize

Olivia Wei

Saint Cuthbert's College

神学赛区

Theology Category

Very High Commendations

Peter Clark, Battle Abbey School

3rd Prize

Caroline Tong

AP Homeschoolers Online Classes

2nd Prize

Ruoxiao Wang

Minhang Crosspoint Middle School

1st Prize

Alex Wang

Cranbrook Kingswood

心理学赛区

Psychology Category

Very High Commendations

Agatha Darragh, Colyton Grammar School

Alina Turaliyeva, Haileybury Almaty

Daisy Sun, West Point Grey Academy

Imogen Ciochon, St. Bartholomew's

Raelle Tiong, Northwood High School

Surabhi Marathe, The Orchid School

Vin Wiemelt, Homeschooled

3rd Prize

Sreyaa Sunjay

King Edwards VI Camp Hill School for Girls

2nd Prize

Johnny Yi

BASIS International School Park Lane Harbour

1st Prize

Jingyi Cheng

The High School Affiliated to Renmin University of China

Grand Prize

GRAND WINNER

Kan Zhang

BASIS International School Park Lane Harbour

2025赛季即将拉开序幕,想要提前备赛的同学可以领取我们的备赛资料包!

扫码免费领取John Locke 七大组别历年获奖论文合集+推荐书单+备赛规划⇓

John Locke 获奖论文集,获奖作品、赛题分析全覆盖!

John Locke备赛必读书单

John Locke写作大纲