2024年的John Locke竞赛放题,今年的题目既有趣味性又充满深度,其中不乏与当下时事紧密相连的话题。不过这些题目一如既往地强调思辨性,旨在挑战参赛者的思维深度和广度,让不少同学感到有些无从下手。今天针对低年级组的题目为大家做一个详细的解读。

2024年初级奖

Q1. Does winning a free and fair election automatically confer a mandate for governing?

赢得自由公正的选举是否会自动赋予执政权力?

第1题思路

选举让选民对政府做出判断并表达他们的意愿。如何设计选举以及如何确定选举结果对于任何国家的民主都是至关重要的。

因此,应该通过民主程序定期仔细地进行辩论,并在缺陷明显时更新设计。针对这道题,同学们需要熟悉民主制度国家的选举流程,思考在赢得选举和获得执政授权之间的步骤。

Q2. Has the anti-racism movement reduced racism?

反种族歧视运动减少了种族歧视吗?

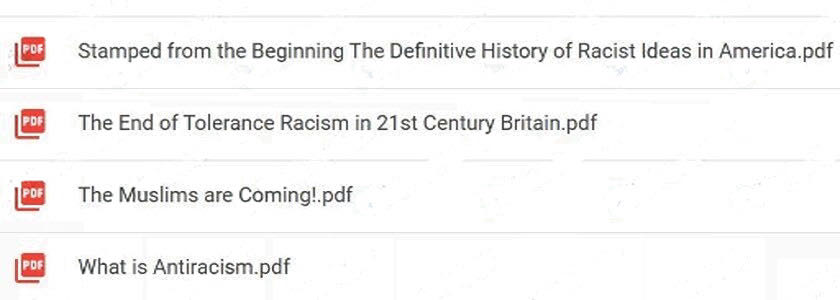

推荐书单

第2题思路

什么是成功的有效的社会运动?我们如何定义这种成功?纽约大学教授Arun Kundnani提出:反种族主义有两种,只有一个有效,而且与“多样性培训”无关,当自由派反种族主义者争论词汇时,激进分子采取直接行动 —— 这是改变制度的唯一途径。

还有学者指出反种族主义运动的问题,比如其二元叙事风格,在大多数当代关于种族的讨论中,对话常常被归结为白人与黑人的二分法,这往往忽视了其他群体的观点。对教育系统的学术研究发现,美国教科书在讨论种族时仅限于黑人/白人二元论。

这道题和去年约翰洛克历史中的一道题目有关联,哪些特征可以区分成功的社会变革运动和不成功的社会变革运动?学生们需要了解反种族主义运动的历史演变、性质、特点和影响。

推荐书单

Q3. Is there life after death?

死后还有生命吗?

第3题思路

在疫情期间——这段漫长而不稳定的损失时期——出版了许多有关悲伤的书籍,这并非偶然。悲伤对作家来说是一种激励:一种度过哀悼的方式,在某些情况下,也是在书页上延续一个人的生活的方式。临床心理学家Vanessa Moore在丈夫突然离世后经常看见白色羽毛,在进行了一些调查之后,她发现很多人都有类似的经历,有的人相信自己和死去的亲人还有某种沟通。

这道题我们可以去思考死亡的定义,濒死体验,投胎转世等相关概念。

Q4. How did it happen that governments came to own and run most high schools, while leaving food production to private enterprise?

政府为什么会拥有并管理大多数中学,而把食品生产留给私营企业?

推荐书单

第4题思路

公共部门与私营部门的概念在现代社会中具有重要意义。公共部门通常指的是由政府或政府机构管理和运营的部门,其主要目标是为公众利益服务,并提供各种公共服务,如教育、医疗、基础设施建设等。私营部门则是由私人企业或组织管理和运营的部门,其主要目标是盈利和市场竞争,在市场经济中发挥重要作用。

政府在公共部门扮演着重要的角色,其权利和责任涵盖了广泛的范围。首先,政府有责任制定和执行法律法规,以维护社会秩序和公共安全。其次,政府负责提供基本的公共服务,如教育、医疗、社会福利等,以满足公民的基本需求。此外,政府还有责任管理国家财政,确保国家经济的稳定和可持续发展。同时,政府还承担了维护国家安全和国际关系的责任,保护国家利益和国民安全。

公众通常希望从政府那里得到各种服务和保障。他们期望政府能够提供优质的教育和医疗资源,保障社会公平和正义,促进经济繁荣和社会发展,以及保护环境和生态平衡。此外,公众也希望政府能够保障基本人权和公民权利,维护社会稳定和公共安全,以及应对突发事件和灾难。

然而,在现实中,政府的能力和资源是有限的,因此政府在履行其权利和责任时常常面临挑战和困难。在有限的资源下,政府需要进行优先考虑和资源配置,以确保最大程度地满足公众的需求和利益。同时,政府还需要与私营部门和其他社会组织合作,共同推动社会发展和进步,实现共同利益和可持续发展的目标。

推荐书单

Q5. When will advancing technology make most of us unemployable? What should we do about this?

科技的进步何时会让我们中的大多数人失业?我们该怎么办?

第5题思路

人工智能对创意产业的影响对演员、音乐家、作家、艺术家、记者和平面设计师的生计构成了重大威胁,引发了人们对工作保障的担忧以及需要采取保障措施来保护他们的权利和报酬。

这道题我们可以缩小讨论的话题范围,拿人工智能制作的艺术作品作为例子,我们可以思考这些作品的价值,为什么人们会感到恐慌。在回答这道题时,我们需要具体和直接地回答“什么时候”和我们的解决方法。是改变我们看待先进技术的态度吗?尽快制定相关的法律和管理政策?

推荐书单

Q6. Should we trust fourteen-year-olds to make decisions about their own bodies?

我们应该相信十四岁的孩子能为自己的身体做出决定吗?

第6题思路

推荐书单

扫码免费领取获奖论文集+推荐书单电子书!